The "tear down for estimate" process in collision repair meticulously assesses vehicle damage, providing accurate estimates for restoration. This method improves communication, streamlines claims, builds trust, and ensures high-quality dent removal and auto painting services through clear documentation and visual aids. It's a structured approach that enhances efficiency, accuracy, and cost control for both repair shops and insurance providers.

In the intricate process of insurance claims management, understanding the ‘tear down for estimate’ method is crucial for both policyholders and insurers. This article delves into the significance of this strategy, offering a comprehensive guide to navigating the estimates phase effectively. We explore the step-by-step tear down process, highlighting its role in accurate damage assessment. Additionally, we provide valuable communication strategies to engage with insurance providers, ensuring smoother claims settlements. Discover how these techniques enhance estimating efficiency and streamline the entire claims journey.

- Understanding the Tear Down Process for Estimates

- Effective Communication Strategies With Insurers

- Streamlining Claims and Estimating Efficiency

Understanding the Tear Down Process for Estimates

The “tear down for estimate” is a meticulous process that forms the foundation for accurate and effective communication with insurance providers in the event of vehicle damage. It involves a comprehensive breakdown of the affected components, meticulously documenting each part’s condition, functionality, and potential replacement needs. This systematic approach ensures that the estimated repair cost reflects the precise requirements for restoration, encompassing everything from structural integrity repairs to intricate dent removal and auto painting applications.

By employing this method, collision repair shops can provide detailed estimates, enabling informed decision-making by both policyholders and insurance companies. It streamlines the claims process, minimizing confusion and delays often associated with complex vehicle damage scenarios. This level of transparency fosters trust and facilitates smoother interactions between customers, their insurance providers, and the chosen collision repair shop, ultimately leading to efficient and high-quality dent removal and auto painting services.

Effective Communication Strategies With Insurers

Effective communication is key when it comes to navigating the process of tear down for estimate and interacting with insurance providers. As a collision repair shop or car repair service, establishing clear and concise lines of dialogue can significantly streamline the claims process. When discussing damage assessments, be prepared to provide detailed notes on each dent repair or fix required, ensuring all parties involved have a comprehensive understanding.

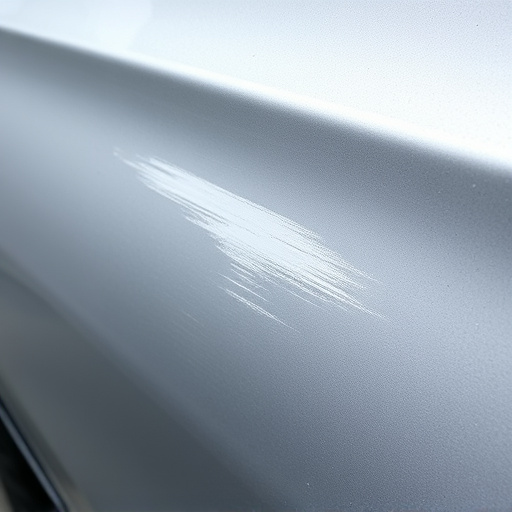

Utilize visual aids whenever possible; photographs of the damaged vehicle from various angles can convey information more effectively than words alone. This visual approach also serves as valuable documentation for future reference. Remember, clear and timely communication fosters trust with insurance providers, enhancing the overall customer experience.

Streamlining Claims and Estimating Efficiency

In the realm of vehicle collision repair, streamlining claims and estimating efficiency is a game-changer. By implementing a meticulous “tear down for estimate” process, repair shops can significantly enhance their operations. This involves thoroughly disassembling the damaged car bodywork to assess the extent of the damage, which in turn enables more accurate auto painting and restoration estimates.

A structured tear down method not only ensures that no hidden issues are overlooked but also facilitates faster turnaround times. Insurance providers benefit from this efficiency as claims processing becomes smoother and more precise. This leads to reduced costs for both parties, with repair shops providing high-quality vehicle collision repair services while insurance companies maintain financial control through accurate estimating.

By understanding the tear-down process for estimates and implementing effective communication strategies with insurance providers, businesses can streamline claims and enhance estimating efficiency. This approach not only saves time but also improves accuracy, leading to better relationships with insurers and happier clients. Embracing these practices is a key step towards revolutionizing the way estimates are handled in today’s digital era.